Qualified Charitable Distribution (QCD): Ozarks Healthcare Foundation shares Tips for boosting Your Tax-efficient Giving Strategy

While Ozarks Healthcare is focused on providing the highest quality of healthcare to all, it cannot be done without the generosity of community members who are also committed to seeing local healthcare thrive. As end-of-year giving opportunities approach, the Ozarks Healthcare Foundation wants to thank donors for investing their time, money, and hearts to help Ozarks Healthcare, while sharing how qualified charitable distributions to organizations such as the Foundation can help lower taxes and reduce the impact to certain tax credits and deductions.

What is the Ozarks Healthcare Foundation?

The Ozarks Healthcare Foundation supports Ozarks Healthcare, ensuring a place close to home to meet all medical needs. The not-for-profit organization was established in 1998 to further the health system’s work. Governed by a local board of directors, the Ozarks Healthcare Foundation seeks and accepts charitable contributions from individuals, businesses, corporations, and other foundations to assist Ozarks Healthcare in providing excellent healthcare to its surrounding region.

Funds donated to the Ozarks Healthcare Foundation help Ozarks Healthcare develop and purchase:

- New medical technology and equipment

- Community wellness, prevention, and other out-of-hospital services to promote quality of life

- Renovation and new facilities

“The Ozarks Healthcare Foundation’s mission of caring for our community simply would not be possible without philanthropic support,” Josh Reeves, Vice President of Development at Ozarks Healthcare, said. “Our Foundation employs the utmost care in the administration and distribution of funds, and we are so appreciative of our donors and the way they contribute to essentially saving lives from our community.”

How can you support the Ozarks Healthcare Foundation?

For individuals of retirement age, there is a particular giving strategy that supports Ozarks Healthcare in bettering medical care for all that can also lead to significant tax savings. This strategy includes donating to the Ozarks Healthcare Foundation using a qualified charitable distribution (QCD).

Giving Through Your Individual Retirement Account (IRA)

If you are 70 ½ years old or older, you can simply donate to the Ozarks Healthcare Foundation and receive tax benefits in return. You may give any amount up to $100,000 per year from your individual retirement account (IRA) directly to a qualified charity, such as the Ozarks Healthcare Foundation, without paying income taxes. This popular gift option is called the IRA charitable rollover or a qualified charitable distribution (QCD).

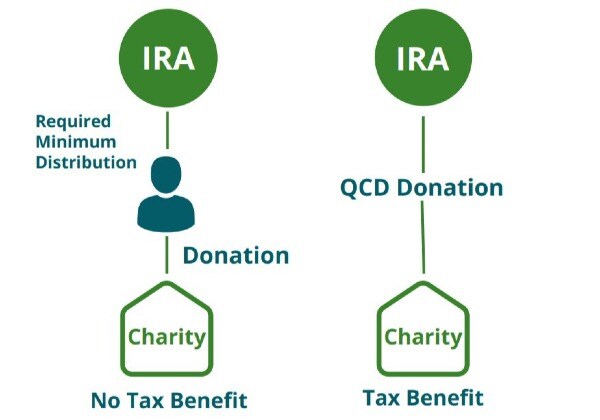

A QCD is a direct transfer of funds from an IRA, made payable to a qualified charity such as the Ozarks Healthcare Foundation, subtracting those funds from your taxable income. Alternatively, taking funds out as in a required minimum distribution (RMD) payable to yourself and then donating it may not reduce your taxable income. There are also additional tax consequences that may incurred.

“The QCD is a good option for people now receiving required minimum distributions from their IRA,” Bill Wood, Chairman of the Ozarks Healthcare Foundation, said. “If you don’t need the funds, then a QCD allows you to simultaneously lower your tax burden while making a meaningful gift.”

If you would like to support the Ozarks Healthcare Foundation through a giving strategy such as the QCD, contact your IRA plan administrator, certified public accountant (CPA), or financial advisor.

The Ozarks Healthcare Foundation, established in 1998 as a not-for-profit 501(c)(3) with a local board of directors, serves as a liaison between donors and Ozarks Healthcare to assist the hospital in providing excellent healthcare to the communities it serves. For more information or to make a gift to the Ozarks Healthcare Foundation, please call 417-853-5200 or visit https://www.ozarkshealthcare.com/support-us/foundation/.

Ozarks Healthcare is a system of care encompassing primary care and specialty clinics, along with complete rehabilitation, behavioral healthcare, and home health services. While the 114-bed acute care hospital cares for more than admissions, the health system has more than 364,000 patient visits annually in South Central Missouri and Northern Arkansas. For more information about Ozarks Healthcare, visit www.OzarksHealthcare.com.

A qualified charitable distribution (QCD) sent directly to a qualified charity such as the Ozarks Healthcare Foundation may provide significant tax benefits. Consult your financial advisor or certified public accountant (CPA) for details.